No.NC-JCM-2020/DOPT (DA)

October 08, 2020

The Secretary,

Government of India,

Department of Personnel & Training,

North Block,

New Delhi

Dear Sir,

Sub : Computation of gratuity and leave encashment in the case of persons retired/to be retired after 1.1.2020 Consequent upon the denial of DA/DR

We invite your kind attention to the orders in F. No. 1/1/2020-E II (B) dated 23.04.2020 wherein the decision of the Government to deny the dearness allowance deafness relief to the employees and pensioners respectively has been conveyed. We had written two letters in the matter on 23rd April 2020 and on 26th May 2020. The undersigned had taken up the issue also with the Cabinet Secretary. when he assured of an informal discussion in the matter with the Staff Side. However. no talks have taken place thereafter. It is not for the first time that the Government is by pausing the National Council. Staff Side. On the last occasion. when the National Council met. we had pointed out the inordinate delay in convening the meetings. We are constrained to believe that the Government wanted the negotiating body to have a burial. I am however duty bound to convey the growing resentment of the employees over this unprecedented decision. As the Government has decided to deny the dearness relief to the pensioners. the pensioner community is in great financial stress as many of them are compelled to spend exorbitant amount for the treatment of Covid.

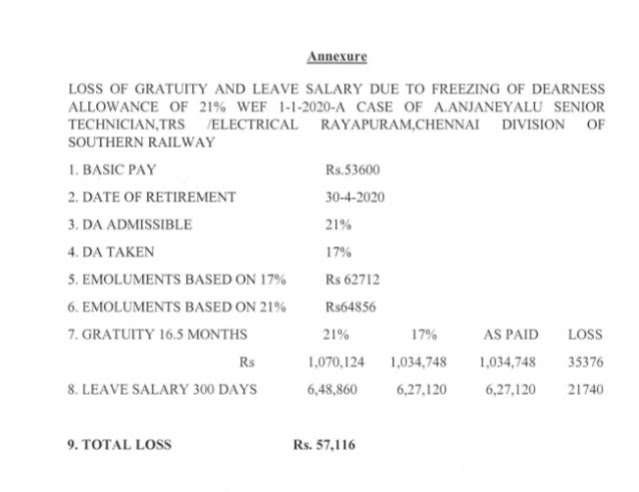

It has been brought to our notice that the denial of DA and freezing the same for Iced 18 months from 1.01.2020 to 1.07.2021 has created a piquant situation for the lower level administrative functionaries to correctly compute the retirement benefits in the case of those civil servants who are retiring after the date of issue of the above cited O.M. The definition of “emoluments” for the purpose of computing the gratuity as also the leave salary (of the accumulated leave) includes Dearness allowance as admissible and not as paid or payable to the Government servant. Without exception. every administrative Department has computed the entitlement on this account only with reference to the Basic pay Dearness allowance paid or received by the concerned individual i.e 17%, Either 21% w.e.f 1-1-2020 or figure increase in percentage are not taken into account while calculating gratuity and leave salary. Since the order of the Finance Ministry clearly stipulates that the Dearness Allowance admissible to the Government servants would be restored on 1.07.2021. the computation of Gratuity and leave salary without taking into account the DA as admissible to the individual Government servant is incorrect. Annexed to this letter is an example as to how the individual loses out if the present faulty, computation procedure is followed It could be seen from the given example, the concerned Government servant will lose a staggering sum of Rs. 57116 because of this faulty computation.

The Government is required to pass the orders as and when the DA has become due, Freezing it for certain period of time or denying it altogether for a specified duration are altogether different issues. Our objection to the adopted policy has already been conveyed to the Government. The faulty computation of Gratuity and Leave salary is not even intended by the order issued by the Government on 23rd April, 2020.

We, therefore. request you to kindly get the matter examined and ensure that

(i) Orders are issued as and when the Dearness allowance has to be revised on the b.is of the cost of living index;

(ii) Direct the administering Ministries to compute the emoluments of persons who are to retire during the period of freezing, taking the correct amount of DA as admissible to receive and not what has been paid to him for computing gratuity and leave salary

(iii) The orders revising the rate of DA DR are to be issued in April, 2020, before September, 2020 and again in April, 2021.

Thanking you,

Yours faithfully,

Shiva Copal Mishra

Secretary