Government proposes to revise the variable dearness allowance for unorganised sector workers? Rajya Sabha QA

GOVERNMENT OF INDIA

MINISTRY OF LABOUR AND EMPLOYMENT

RAJYA SABHA

UNSTARRED QUESTION NO. 2017

TO BE ANSWERED ON 12.12.2024

REVISION OF VARIABLE DEARNESS ALLOWANCE

2017. SHRI JAGGESH:

Will the Minister of Labour and Employment be pleased to state:

(a) whether it is a fact that there is a need to help unorganised sector workers to cope with the rising cost of living;

(b) whether Government proposes to revise the variable dearness allowance for unorganised sector workers, effectively increasing monthly wages;

(c) if so, the details thereof; and

(d) the details of measures taken by Government for effective implementation of revised wages in the unorganised sector?

ANSWER

MINISTER OF STATE FOR LABOUR AND EMPLOYMENT

(SUSHRI SHOBHA KARANDLAJE)

(a) to (d): Under the provisions of the Minimum Wages Act 1948, the Central Government and the State Governments, are appropriate Governments, to fix, review and revise the minimum wages of the workers employed in the Scheduled employments under their respective jurisdiction.

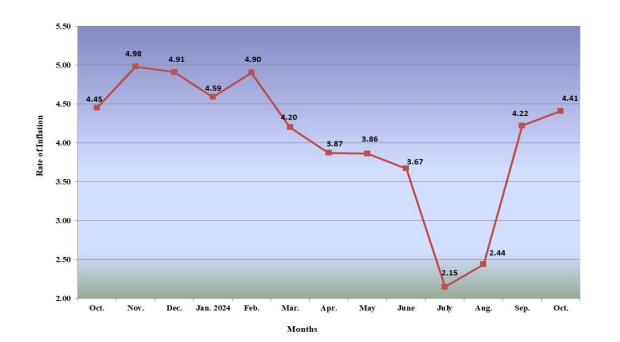

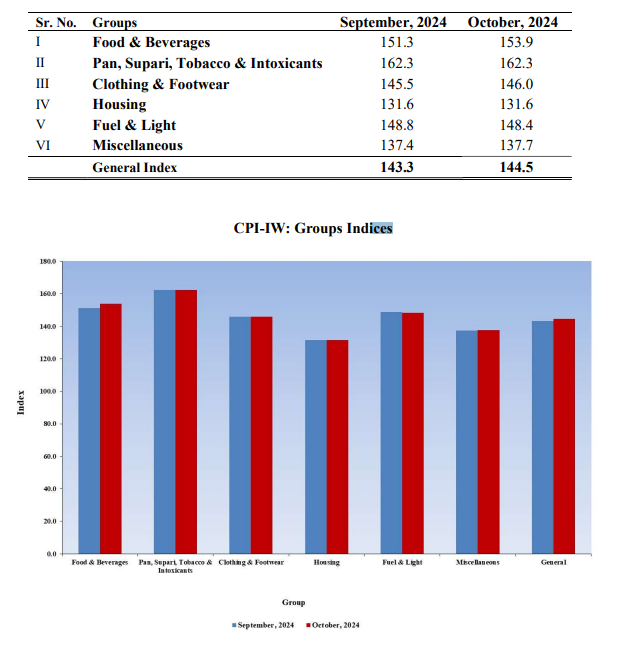

Further, in order to take care of the rising prices, the Central Government revises the Variable Dearness Allowance (V.D.A) on basic rates of minimum wages every six months, effective from 1st April and 1st October of every year on the basis of Consumer Price Index for Industrial workers.

The provisions of the Minimum Wages Act, 1948, have been rationalized and subsumed under the Code on Wages, 2019. The components of minimum wages stipulated therein also provide for cost of living allowance. The Code makes minimum wages universally applicable across employments and thus moves ahead from restrictive applicability of minimum wages limited to scheduled employments as provided for under the Minimum Wages Act, 1948.

Follow us on WhatsApp, Telegram Channel, Twitter, Facebook and Android App for all latest updates