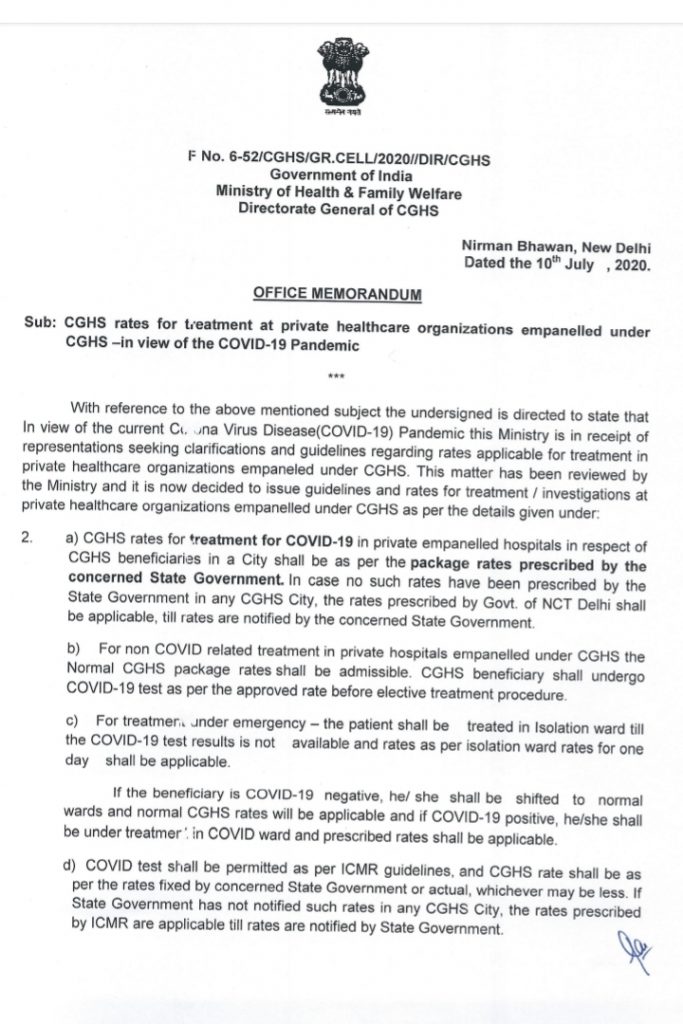

F No. 6-S2/CGHS/GR.CELL/2020/DIR/CGHS

Government of India

Ministry of Health & Family Welfare

Directorate General of CGHS

Nirman Bhawan, New Delhi

Dated the 10th July , 2020.

OFFICE MEMORANDUM

Sub : CGHS rates for treatment at private healthcare organizations empanelled under CGHS -in view of the COVID-19 Pandemic.

With reference to the above mentioned subject the undersigned is directed to state that In view of the current Corona Virus Disease (COVID-19) Pandemic this Ministry is in receipt of representations seeking clarifications and guidelines regarding rates applicable for treatment in private healthcare organizations empanelled under CGHS, This matter has been reviewed by the Ministry and it is now decided to issue guidelines and rates for treatment / investigations at Private healthcare organizations empanelled under CGHS as per the details given under:

2. a) CGHS rates for treatment for COVID-19 in Private empanelled hospitals in respect of CGHS beneficiaries in a City shall be as per the package rates prescribed by the concerned State Government. In case no such rates have been prescribed by the State Government in any CGHS City, the rates Prescribed by Govt. of NCT Delhi shall be applicable, till rates are notified by the concerned State Government.

b) For non COVID related treatment in private hospitals empanelled under CGHS the Normal CGHS package rates shall be admissible. CGHS beneficiary shall undergo COVID-19 test as per the approved rate before elective treatment procedure.

c) For treatment, under emergency — the patient shall be treated in Isolation ward till the COVID-19 test results is not available and rates as per isolation ward rates for one day shall be applicable.

If the beneficiary is COVID-19 negative, he/ she shall be shifted to normal wards and normal CGHS rates will be applicable and if COVID-19 positive, he/she shall be under treatment in COVID ward and Prescribed rates shall be applicable.

d) COVID test shall be permitted as per ICMR guidelines, and CGHS rate shall be as per the rates fixed by concerned State Government or actual, whichever may be less. If State Government has not notified such rates in any CGHS City, the rates prescribed by ICMR are applicable till rates are notified by State Government.

3. It is once again reiterated that all CGHS empanelled hospitals , which are notified as COVID-Hospitals by State Governments shall provide treatment facilities to CGHS beneficiaries as per the CGHS norms and as per the rates prescribed above, for all COVID related treatments.

Similarly, it is again reiterated that all the CGHS empanelled hospitals, which are not notified as COVID Hospitals shall not deny treatment facilities / admission to CGHS beneficiaries and shall charge as per CGHS norms, for all other treatments.

Suitable action shall be taken in case of violation of the guidelines.

CGHS empanelled healthcare organizations shall perform the treatment / test on Cashless basis in respect of pensioners, etc, and submit the bills to CGHS through UTI-ITSL. The reimbursement for the cost of expenditure on the test at approved rate shall be reimbursed by concerned Ministry / Department / Organization in respect of serving employees and beneficiaries of Autonomous Bodies,

4. These orders come into effect from the date of issue till further orders.

5. This issues with the concurrence of Integrated Finance Division, MoHFW vide CD No 805 dt 10.07.2020.

(Dr. Sanjay Jain)

Director, CGHS