Children Education Facilitation Allowance for Gramin Dak Sevaks

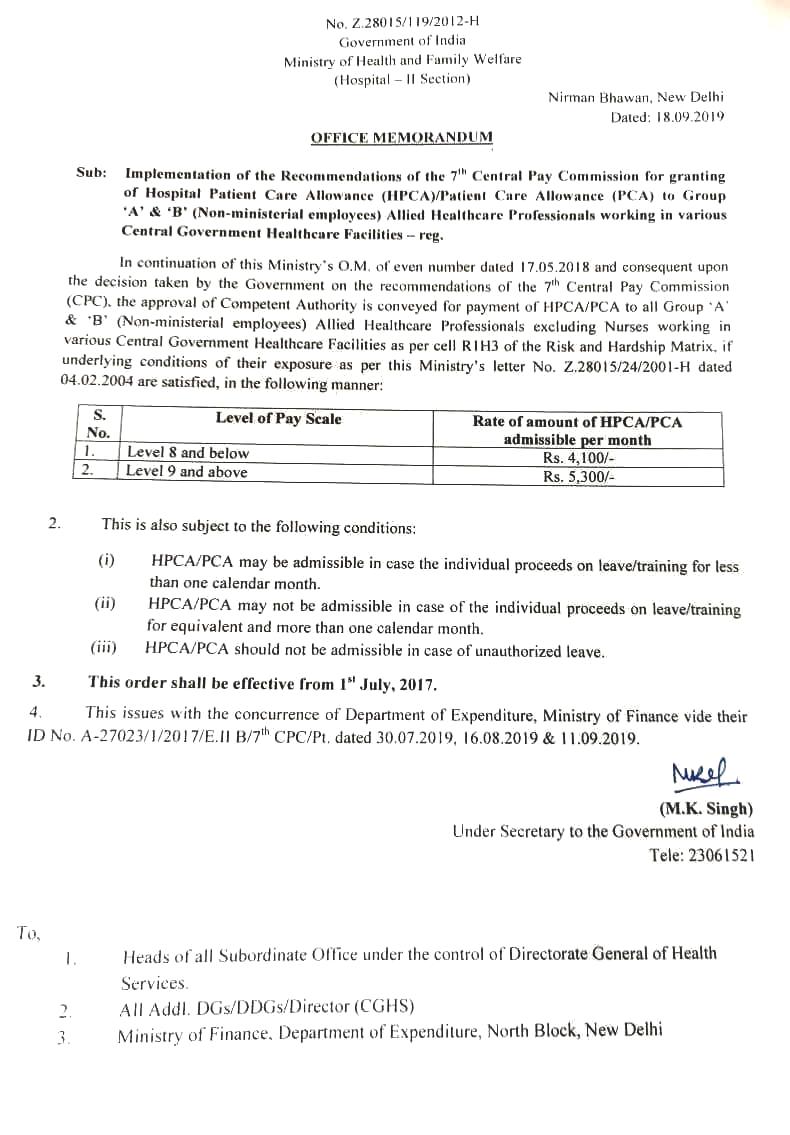

No.17-31/2016-GDS

Government of India

Ministry of Communications

Department of Posts

(Establishment Division)

Dak Bhawan, Sansad Marg,

New Delhi – 110001

Dated: 18.09.2019

Office Memorandum

Subject : Implementation of recommendations of One-Man Committee on introduction of Children Education Facilitation Allowance for Gramin Dak Sevaks (GDS).

The undersigned is directed to convey the approval of the Competent Authority on recommendations of One-Man Committee on introduction of Children Education Facilitation Allowance for Gramin Dak Sevaks (GDS).

2.Keeping in view the above, it has been decided to issue consolidated instructions on the subject of Children Education Facilitation Allowance as under :-

(i) The reimbursement of Children Education Facilitation Allowance can be claimed only for the two eldest surviving children with the exception that, in case the second child birth results in twin/multiple birth. In case of failure of sterilization operation, the Children Education Facilitation Allowance would be admissible in respect of children born out of the first instance of such failure beyond the usual two children norm-

(ii) The amount of reimbursement of Children Education Facilitation Allowance will be Rs.6000/- per annum (fixed) per child. This amount of Rs.60001 is fixed irrespective of the actual expenses incurred by the GDS. In order to claim reimbursement of Children Education Facilitation Allowance, the GDS should produce a certificate issued by the Head of the Institution for the period, /year for which claim has been preferred. The Certificate should confirm that the child studied in the school during the previous academic year. In case such certificate cannot be obtained, self-attested copy of the report card or self-attested fee receipt(s) {including ereceipt(s)) confirming/indicating that the fee deposited for the entire academic year can be produced as a supporting document to claim Children Education Facilitation Allowance. The period-/year means academic year i.e twelve months of complete academic session.

(iii) Children Education Facilitation Allowance can be claimed in a single form only for the two eldest surviving children with the exception that, in case the second child birth results in twin/multiple birth (SEE Proforma enclosed).

(iv) In case both the spouses are GDS/Government servant, only one of them can avail reimbursement under children Education Facilitation Allowance or CEA (in case of Government servant).

(v) The reimbursement of Children Education Facilitation Allowance will be done just once in a financial year after completion of the financial year.

(vi) The reimbursement of Children Education Facilitation Allowance shall have no nexus with the performance of the child in his/her class. In other words, even if a child fails in a particular crass, the reimbursement of children Education Facilitation Allowance shall not be stopped. However, if the child is admitted in the same class in another school, although the child has passed out of the same class in previous school or mid- session, Children Education Facilitation Allowance shall not be reimbursable.

(vii) If a GDS dies while in service, the children Education Facilitation Allowance shall be admissible in respect of his/her children subject to observance of other conditions for its grant provided the wife/husband of the deceased is not engaged as GDS or not employed in service of the central Govt., State Government, Autonomous body, PSU, Semi Government organization such as Municipality, Port Trust Authority or any other organization partly or fully funded by the central Govt./state Governments. In such cases the children Education Facilitation Allowance shall be payable to the children till such time the GDS would have actually received the same, subject to the condition that other terms and conditions are fulfilled. The payment shall be made by the office in which the GDS was working prior to his death and will be regulated by the other conditions, Laid down in this OM.

Also Read : 7th CPC Children Education Allowance

(viii) In case of discharge, dismissal or removal from engagement, Children Education Facilitation Allowance shall be admissible till the end of the academic year in which the GDS ceases to be in engagement due to discharge, dismissal or removal from engagement in the course of an academic year. The payment shall be made by the office in which the GDS worked prior to these events and will be regulated by the other conditions laid down in this OM.

(ix) The upper age limit for Divyaang children has been set at 22 years. In the case of other children the age limit will be 20 years or till the time of passing 12th class whichever is earlier. There shall be no minimum age.

(x) Reimbursement of Children Education Facilitation Allowance shall be applicable for children from class nursery to twelfth, including classes eleventh and twelfth held by the junior Colleges or school affiliated to Universities or Boards of Education.

(xi) Children Education Facilitation Allowance is allowed in case of children studying through “Correspondence or Distance Learning” subject to other conditions laid down in this OM.

(xii) The. Children Education Facilitation Allowance is admissible in respect of children studying from two classes before class one to 12th standard and also for the initial two years of a diploma/ certificate course from Polytechnic/ ITl/Engineering College, if the child pursues the course after passing 10th standard and the GDS has not been granted Children Education Facilitation Allowance in respect of the child for studies in 11th and 12th standards.

(xiii) In respect of schools/institutions at nursery, primary and middle level not affiliated to any Board of education, the reimbursement under the Scheme may be allowed for the children studying in a recognized school/institution. Recognized school/institution in this regard means a Government school or any education institution whether in receipt of Govt. Aid or not, recognized by the Central or State Government or Union Territory Administration or by University or a recognized educational authority having jurisdiction over the area where the institution /school is situated.

(xiv) In case of a Divyaang child studying in an institution i.e. aided or approved by the Central/ State Govt. or UT Administration or whose fees are approved by any of these authorities, the Children Education Facilitation Allowance paid by the GDS shall be reimbursed irrespective of whether the institution is ‘recognized’ or not. In such cases the benefits will be admissible till the child attains the age of 22 years. –

(xv) The children Education Facilitation Allowance shall be admissible to a GDS while he/she is on duty or is under put off duty or is on leave. Provided that during any period which is treated as non-counted for duty’, the GDS shall not be eligible for the children Education Facilitation Allowance for that period.

3.These above instructions would come into effect from 1st October 2019. For the current financial year, GDS shall be eligible for CEFA @ Rs.6000/- per child.

4.This issue in consultation with Department of personnel and training vide their ID No DoP&T I.D.No. A-27012/02/2018-Estt. (AL) dated 05.09.2018 & Department of Expenditure, Ministry of Finance, ID Note No.7-31/2016-E.III(A) dated 06.09.2019/eFTS 1170513/2019.

5.Hindi version will follow.

(S B.Vyavahare)

Assistant Director General (GDS/PCC)

Signed Copy & Proforma