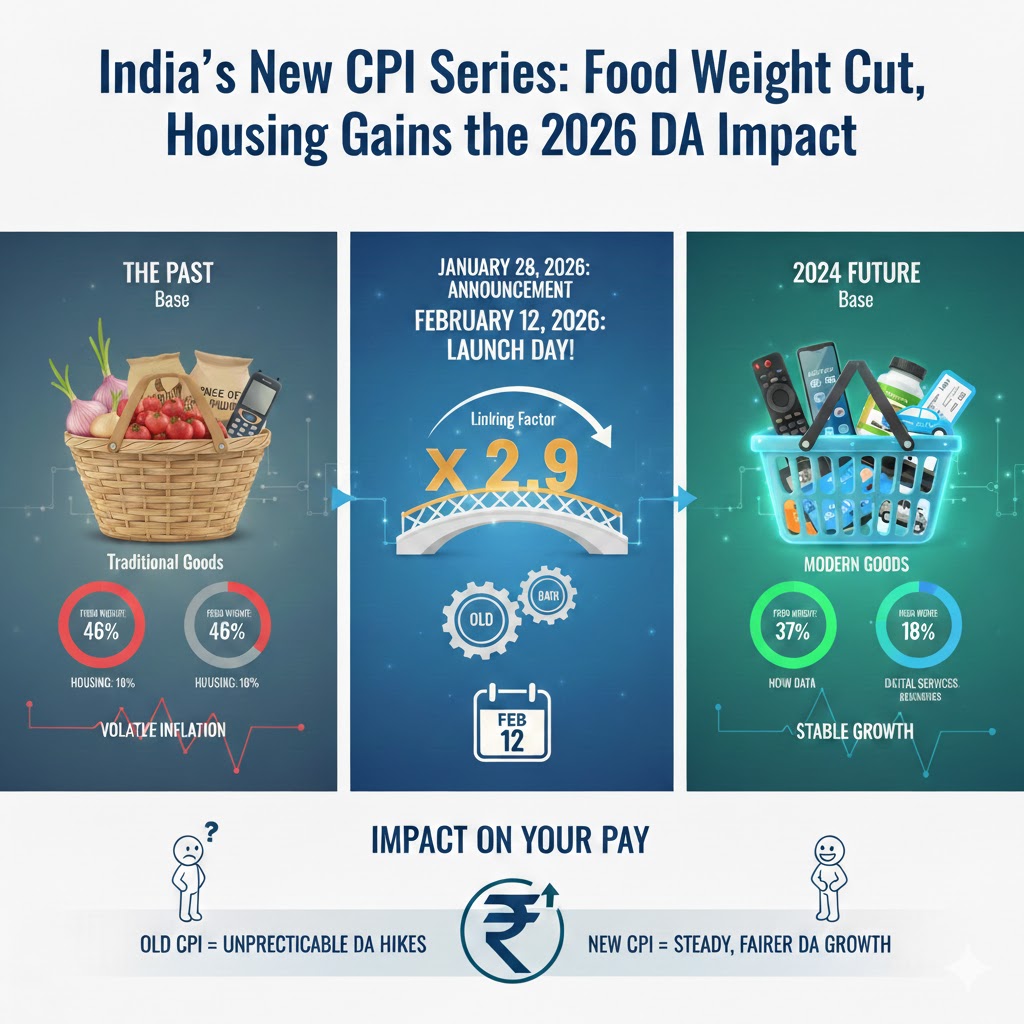

New CPI Series: Food Weight Cut, Housing Gains, and the 2026 DA Impact

The Government of India is undertaking a historic overhaul of its economic indicators, most notably resetting the Consumer Price Index (CPI) base year from 2012 to 2024. This shift is designed to align official data with the actual spending habits of a digital-first, 21st-century India. For millions of government employees, this isn’t just a statistical change—it directly alters the trajectory of Dearness Allowance (DA).

Key Announcement Dates & Timeline

The Ministry of Statistics and Programme Implementation (MoSPI) has followed a transparent roadmap leading up to the final launch:

- January 28, 2026: Official announcement of the 2024 base year completion.

- January 30, 2026: Final pre-release workshop in Chennai to brief stakeholders on the new methodology.

- February 12, 2026: The official launch date. MoSPI will release the first inflation print for January 2026 under the new series.

- February 12, 2026 (Back-series): Simultaneous release of “back-series” data from 2013 onwards to allow for historical comparison

Structural Changes: What’s in the New Basket?

The new index reflects “Engel’s Law”—the economic principle that as people get richer, they spend a smaller percentage of their income on food and more on services.

| Feature | Old Series (2012) | New Series (2024) |

| Food & Beverages Weight | 45.86% | 36.75% |

| Housing Weight | 10.07% | 17.66% |

| Item Count | 299 | 358 |

| New Categories | Limited traditional items | OTT, E-commerce, Airfares, Ride-hailing |

Methodological Upgrades:

- E-commerce Integration: For the first time, weekly prices from 12 major e-commerce platforms are tracked.

- Rural Housing: House rent indices are now being compiled for rural areas, fixing a major gap in the old data.

- Global Standards: Adoption of the COICOP 2018 framework ensures India’s inflation data is globally comparable

Impact on Dearness Allowance (DA)

The DA is a cost-of-living adjustment for government employees and pensioners. The move to the 2024 base introduces two critical changes:

1. The Linking Factor

To prevent a “reset” of DA to 0%, the government uses a Linking Factor (a multiplier) to bridge the 2012 and 2024 series. If the new index starts at 100, the linking factor ensures that your current DA (e.g., 60% as of early 2026) remains the starting point for future growth.

2. Stability vs. Volatility

- Reduced Food Influence: Under the old 2012 base, a spike in vegetable prices often led to massive DA jumps. With food weight down to ~37%, these spikes will have a “diluted” effect.

- Service-Driven Growth: Because Housing and Services (which rarely decrease in price) now have higher weights, DA hikes are expected to be more stable and consistent rather than erratic.

Expert Insight: In periods of low food inflation, the new 2024 series may actually result in a higher inflation print (and higher DA) than the old series because it captures the rising costs of internet, education, and rent more effectively.

Summary of Impact

This revision ensures that the government is compensating its workforce based on a realistic “Cost of Living”—one that includes the smartphone in their pocket and the streaming service on their TV, rather than just the grain in their pantry