Abolition of National Pension System and for restoration of Old Pension Scheme

Annexure-I

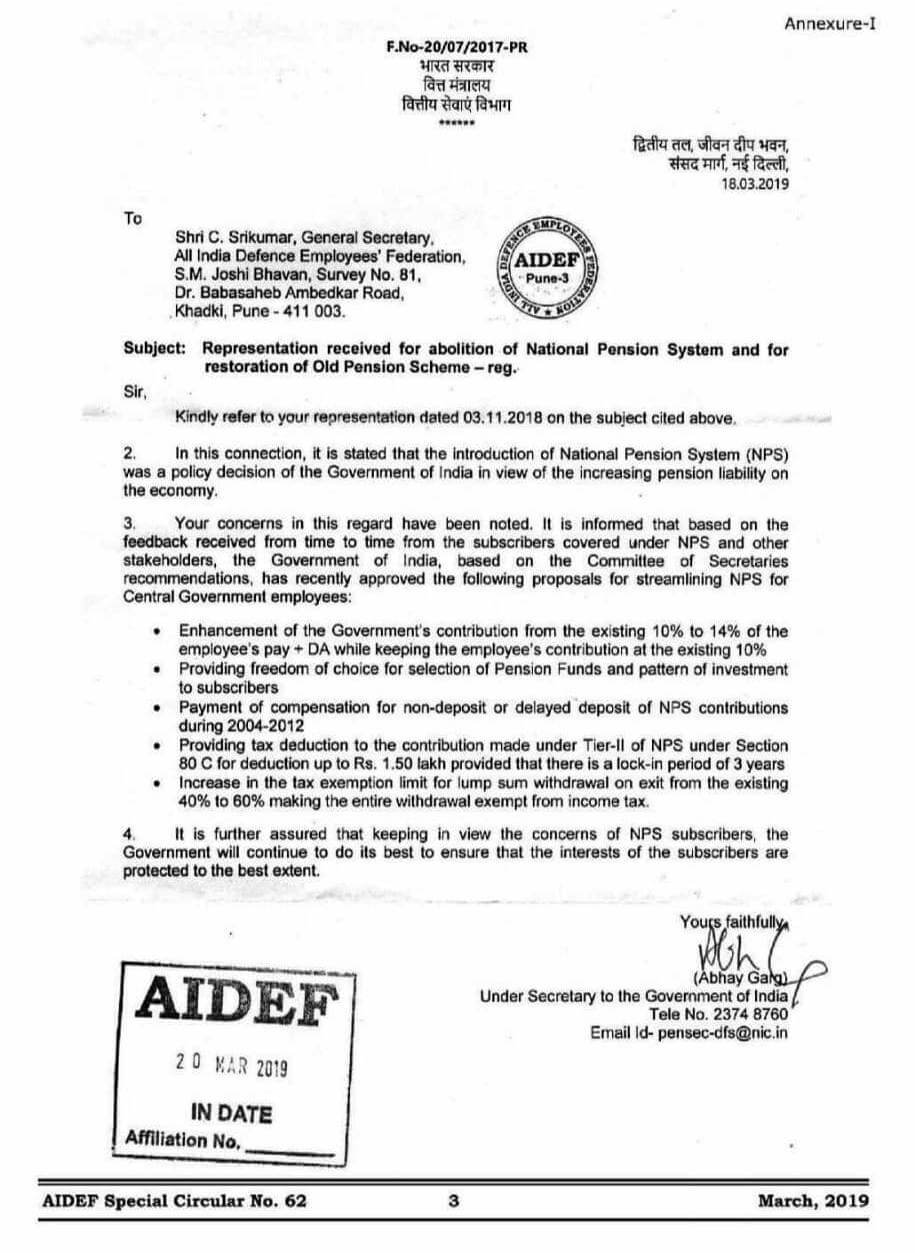

F.No-20/07/2017-PR

भारत सरकार

वित्त मंत्रालय

वित्तीय सेवाएं विभाग

****

द्वितीय तल, जीवन द्वीप भवन,

संसद मार्ग, नई दिल्ली,

18.03.2019

To

Shri C. Srikumar, General Secretary,

All India Defence Employees’ Federation,

S.M. Joshi BhavanI, Survey No. 81 ,

Dr. Babasaheb Ambedkar Road,

Khadki, Pune – 411 003.

Subject: Representation received for abolition of National Pension System and for restoration of Old Pension Scheme – reg.

Sir,

Kindly refer, to your representation dated 03.11.2018 on the subject cited above.

2. In this connection, it is started that the introduction of National Pension System (NPS) was a policy decision of the Government of India in view of the Increasing pension liability on the economy.

3. Your concerns In this regard have been noted. It Is informed that based on the feedback received from time to time from the subscribers covered under NPS and other stakeholders, the Government of India, based on the Committee of Secretaries recommendations, has recently approved the following proposals for streamlining NPS for Central Government employees.

- Enhancement of the Government’s contribution from the existing 10% to 14% of the employee’s pay + DA While keeping the employee’s contribution at the existing 10%.

- Providing freedom of choice for selection of Pension Funds and pattern of investment to subscribers

- Payment of compensation for non-deposit or delayed deposit of NPS contributions during 2004-2012

- Providing tax deduction to the contribution made under Tier-II of NPS under Section 80 C for deduction up to Rs. 1.50 Iakh provided that there is a lock in period of 3 years

- Increase In the tax exemption limit for lump sum withdrawal on exit from the existing 40% to 60% making the entire withdrawal exempt from Income tax.

4. It is further assured that keeping in view the concerns of NPS subscribers, the Government will continue to do its best to ensure that the Interests of the subscribers are protected to the best extent.

Yours faithfully,

(Abhay Garg)

Under Secretary to the Government of India

Source : Confederation