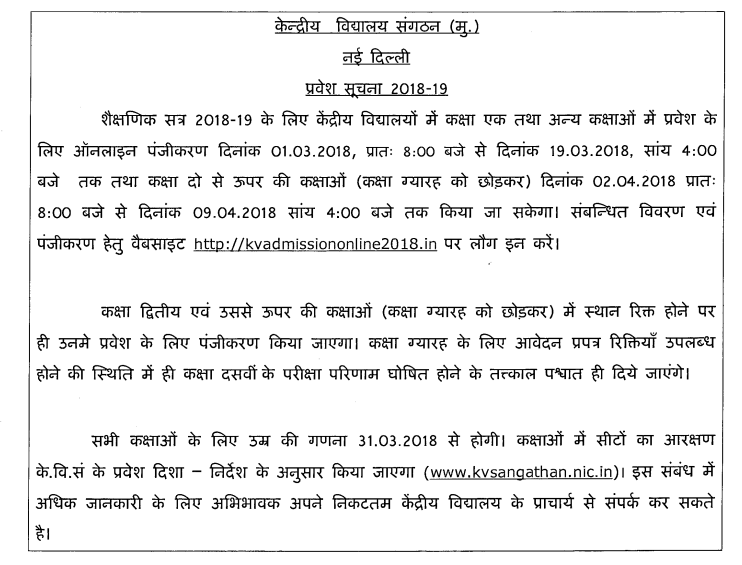

Kendriya Vidyalaya Admission 2018-19 – Method of Admission for Class I

Kendriya Vidyalaya Sangathan released the guidelines for admission process in KV for the year 2018-19. Check the Method of Admission for Class I

Out of the available seats of fresh admission 15% will be reserved for SC and 7.5% will be reserved for ST. The short fall in the number of seats reserved for SC and ST, will be worked out after considering number of SC/ST children admitted under RTE quota.

(1) In first phase, 10 seats (out of 40 seats) in Class I per section are to be filled as per RTE Provisions (25% of seats) and these 10 seats will be filled by draw of lots from all applications of SC/ST/EWS/BPL/OBC (Non-Creamy Layer)who are the resident of Neighborhood/Differently abled taken together.

(2) In second phase; remaining seats are to be filled as per existing Priority category system. The short fall in the seats reserved for SC/ST, if any shall be made good by admitting SC/ST applicants.

For example : In a single Section School 6 seats are reserved for SC and 3 Seats for ST (15% for SC and 7.5% for ST). Assuming that, 2 SC candidates, 1 ST candidate and 1 Differently Abled candidate are admitted under RTE in the lottery system in first phase, then available SC seats will be considered as 6-2 = 4 and ST seats will be 3-1 = 2. The left out registered candidates from SC and ST category will be considered as per order of Priority categories for admission. In this case the remaining 24 seats will be available for admission under order of Priority of Category.

Note-I:

a) In no case the seats reserved as per RTE will be de-reserved.

b) The seats reserved for SC/ST may be interchanged, by interchanging SC seats to ST and vice- versa after 201″ April.

c) If required numbers of candidates covered under RTE do not register in 1st spell of registration then a second notification may be given in the month of April.

d) The definition/eligibility criteria of Disadvantaged Group/Weaker Section/BPUOBC (Non-creamy layer) will be as per the notification of the concerned State Governments.(The DC KVS RO Concerned may issue guidelines regarding BPL/EWS as per the latest notification of the concerned State Governments).

e) Admission test will not be conducted for Class 1.

Note-2:

A DEFINITION OF DISADVANTAGED GROUP

1. Child belonging to disadvantaged group means a child belonging to the Scheduled Caste, Scheduled Tribe, the socially and educationally backward class or such other group having disadvantage owing to social, cultural, economic, geographical, linguistic, gender or such other factor as may be specified by the appropriate government, by notification (Section 2(d) of RTE Act).

2. Child with special needs and suffering from disability will be determined as per the provision mentioned in RTE Act 2009 or as defined by the concerned State Govt.

B DEFINITION OF WEAKER SECTION

Child belonging to weaker section means a child belonging to such a parent or guardian (declared by a Court or a Statute) whose annual income is lower than the minimum limit specified by the appropriate government, by notification (Section 2(e)).

The income limit regarding economically weaker sections will be applicable as notified by the State Govt. concerned.

C. DEFINITION OF NEIGHBOURHOOD & PROOF OF RESIDENCE (APPLICABLE FOR ADMISSION UNDER RTE ONLY)

Since Kendriya Vidyalayas are located at places with varied density of population, they have been categorized as follows for determining the limits of neighbourhood:

Major cities and Urban area 5 kms. Radius

(All District Hors. & Metros)

2 Places and areas other than 8 kms Radius included in I above.

Note:

1. Proof of residence shall have to be produced by all applicants. However, admission cannot be denied due to non-submission of Proof of residence.

2. A self-declaration in writing from the parent about distance may also be accepted to this effect.