8th Central Pay Commission: NC (JCM) Staff Side Circular on decisions and call for Memorandum Submission

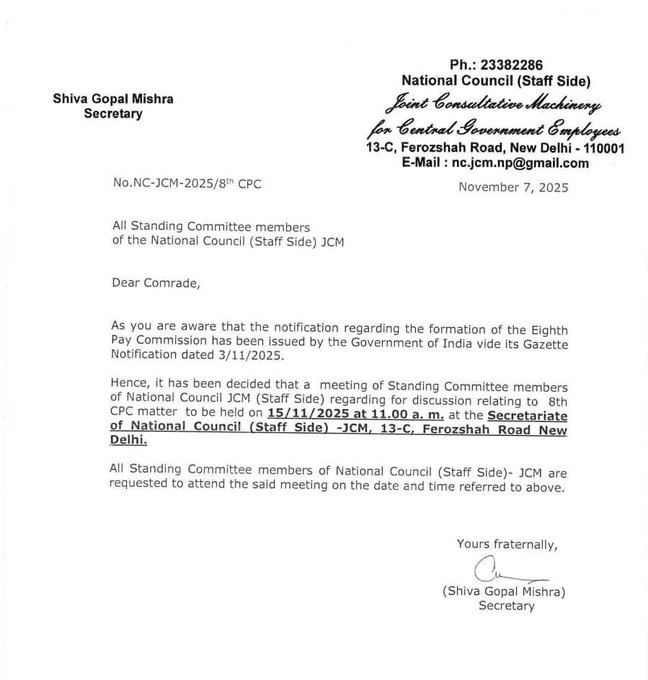

Shiva Gopal Mishra

Secretary

Ph.: 23382286

National Council (Staff Side)

Saint Consultative Machinery for Central Government Employees

13-C, Ferozshah Road, New Delhi – 110001

E-Mail : [email protected]

No.NC-JCM-2025/8th CPC

November 17, 2025

To

All Members of National Council – JCM

&

Constituent Organizations of National Council – JCM

Dear Comrades,

An extended meeting of the Staff Side Members of the Standing Committee of National Council- JCM was held at New Delhi on 15/11/2025 to discuss about the Gazette Notification dated 03/11/2025 issued by the Government of India on appointment of the 8th Central Pay Commission and its Terms of Reference and also to discuss and decide about the future course of action by the Staff Side of National council – JCM.

The following representatives of various constituent Organizations were present in the meeting.

S/Shri M. Raghaviah, Shiva Gopal Mishra, S.N. Pathak, J.R. Bhosle, Guman Singh, C. Srikumar, B.C. Sharma, Rupak Sarkar, Tapas Bose, Amal Kumar Das, Ashok Kumar Singh, Mukesh Kumar Singh, P.U. Khadse, Shivaji Vasareddy and L. N. Pathak.

Secretary Staff Side and Leader Staff Side welcomed the participants and explained in brief about the Terms of Reference given to the 8th CPC and also informed about the suggestions received from various organizations on the Terms of Reference. All the participants were requested to place their views on the Terms of Reference and proposals to be forwarded to the Government. All the representatives placed their views and proposals and after discussion the following decisions were taken unanimously: –

- A letter from the Secretary Staff Side will be addressed to the Hon’ble Prime Minister with copy endorsed to the Hon’ble Finance Minister, Cabinet Secretary, Secretary Department of Expenditure and Secretary DOPT in corporating the amendments required to be made in the ToR and for incorporation of additional Terms of Reference especially with regard to the restoration of Old Pension Scheme and also to include in the Terms of Reference about the revision of Pensionary benefits to existing pensioners and family pensioners under the Central Government, Autonomous Bodies and other entities covered under the Commission also deletion of the ToR (f) (iii) the “unfunded cost of non contributory Pension Scheme”.Retirement Planning Services

2. All the constituent Organizations will be requested to forward their views and inputs with regard to the following topics for preparation of the memorandum to be submitted to the 8th CPC by the Staff Side of National Council (JCM).

- i. Fixation of Minimum wage with full justification like calories required for a Adult, number of family units, additional food, non food and clothing items to be included, prices of the ingredients of all food items, by collecting the retail price from government grocery stores, State Government Cooperative Consumer Stores etc, additional percentage to be added for festivals, social obligations etc and to meet the expenditure on essential technological day to day requirements etc.

- The fitment factor for the existing employees

- Fixation of the highest salary

- Proposed pay structure and annual increment

- Fixation of pay on promotion and MACP

- Date of effect of the recommendations of the pay commission

- Revision of Special Pay granted to different categories

- Issues pertaining to common categories in Central Government like Artisan, Clerical/ Ministerial Staff, Storekeeping staff, Accounts and Audit Staff, Drivers, Fire fighting Staff, MTS, Para Medical Staff, Nursing Staff, Teachers, Canteen Staff, Receptionist, Library Staff, Laboratory Staff, Veterinarians, Scientific Staff, Engineering Staff, Supervisory Staff, Drawing Office Staff, Photographers etc.

- Classification of Posts

- Gramin Dak Sevaks

- Allowances and Advances

- Transport Allowance

- Deputation Duty Allowance

- Travelling Allowance and TA on Transfer

- Children Education Allowance

- Daily Allowance

- Overtime Allowance

- Risk Allowance / Risk and Hardship Matrix

- Night Duty Allowance

- Patient Care Allowance / Nursing Allowance

- Special Allowances in NE Region, High Altitude Allowance

- All types of Advances and any other additional advance to be added

- Housing facilities including HBA

- House Rent Allowance

- Promotion Policy and MACP Scheme

- Central Government Employees Group Insurance Scheme

- All Leave related issues

- Leave Travel concession

- Medical Facilities (CS MA Rules and CGHS)

- Women Employees

- Compassionate Ground Appointment

- Regularization of Contract / Casual / Fixed Term employment employees

- Bonus

- Parity between Central Secretariate and Field offices

- Transfer Policy

- Litigation on Service Matter

- Restoration of Old Pension Scheme

- Revision of Pension for all pre 01/01/2026 pensioners and related matters including Death cum Retirement Gratuity, commutation of Pension, enhancement of Pension / Family Pension etc

- Effective functioning of JCM Scheme at all levels and Grievance redressal Machinery etc

- Miscellaneous items

All the constituent Organizations are requested to submit their views with supporting documents / judgments if any referred on or before 15/12/2025 to the Office of the Staff Side of NC JCM through email (email Id nc.jcm.np[at]gmail.com) and by speed post. No extension of date can be given since after receipt of the views from all Organizations the Drafting Committee has to study each report and then formulate its views for finalizing the Staff Side memorandum.

- After the Staff Side of the National Council – JCM finalize its reports / memorandum on the above mentioned common service matters of Central Government Employees, the Constituent Organizations may submit their respective memorandums endorsing the same in their memorandum and also incorporating their cadre related issues and issues and problems specific to their Department / Organization separately. We have not yet received the nomination Constituent Organizations.

All of you are aware that this office vide letter dated 23/04/2025 have requested to nominate the representatives to be the members of the Drafting Committee as per the following quota distributed to each Organization

| Organization | Representatives |

|---|---|

| 1. AIRF | 3 Representatives |

| 1. NFIR | 3 Representatives |

| 2. AIDEF | 2 Representatives |

| 3. INDWF | 1 Representative |

| 4. BPMS | 1 Representative |

| 5. CDRA | 1 Representative |

| 6. ITEF | 1 Representative |

| 7. Audit & Accounts | 1 Representative |

| 8. NFPE | 1 Representative |

| 9. FNPO | 1 Representative |

| 10. NAAF | 1 Representative |

The respective Organizations may nominate their Staff Side Members on or before 25/11/2025

A copy of this office letter dated 17/11/2025 addressed to the Hon’ble Prime Minister on the subject of Request for Amendments in the Terms of Reference (ToR) of the 8th Central Pay Commission (CPC) and for Inclusion of Pension Revision for Existing Pensioners and Family Pensioners is enclosed for your information.

With greetings

Yours comradely,

(Shiva Gopal Mishra)

Secretary

Follow us on WhatsApp, Telegram, Twitter and Facebook for all latest updates