7th CPC Salary Calculator from Jan 2023: Revised DA & TA – Ready Reckoner

7th CPC Salary Calculator from Jan 2023: The Union Cabinet approves an additional 4 percent Dearness Allowance for Central Government Employees and Dearness Relief to pensioners with effect from 1st Jan 2023

Dearness Allowance payable to Central Government employees shall be enhanced from the existing rate of 38% to 42% of the basic pay with effect from 1st Jan 2023

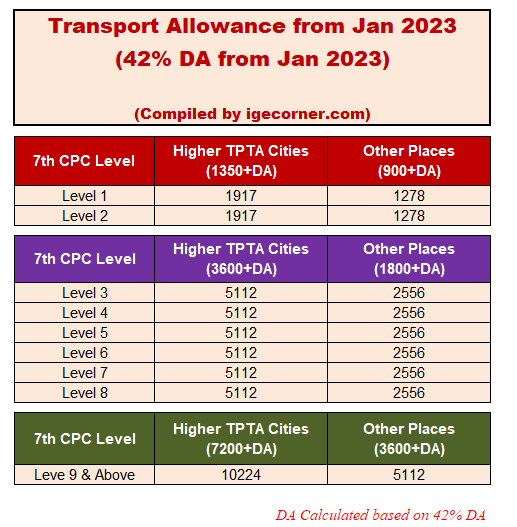

Transport Allowance, Dearness Allowance, and Total Salary will also change based on the 42 percent dearness allowance, also pensioners can check the updated DR calculator

7th CPC Transport Allowance

As per the 7th CPC recommendation, Transport Allowance will also change based on the latest Dearness Allowance percentage.

7th Pay Commission Recommendation for Transport Allowance

The central government implemented the 7th Pay Commission Transport Allowance and released Office Memorandum No.21/5/2017-E.II (B) dated 7th July 2017, in addition to this OM, FinMin also released another Office Memorandum on 2nd August 2017 O.M No.21/5/2017-E.II(B) with partial modification on Transport Allowance to CG Employees for the pay of Rs.24200/- & above in Pay Level 1 & 2

Transport Allowance Ready Reckoner from Jan 2023

7th CPC Salary Calculator from Jan 2023

Check the updated 7th CPC Salary Calculator from Jan 2023 for Revised Pay & Allowances.

7th CPC Dearness Relief Calculator from Jan 2023

Check the updated 7th CPC Dearness Relief Calculator from Jan 2023 for Pensioners

Important Links

| 7th CPC Salary Calculator (updated on Mar 2023) | Click here |

| 7th CPC Dearness Relief Calculator from Jan 2023 | Click here |

| 7th CPC Transport Allowance | Click here |

| DA Calculation Sheet | Click here |

| Expected DA Calculator from July 2023 | Click here |

| Pay Matrix | Click here |

Follow us on Telegram Channel, Twitter and Facebook for all latest updates