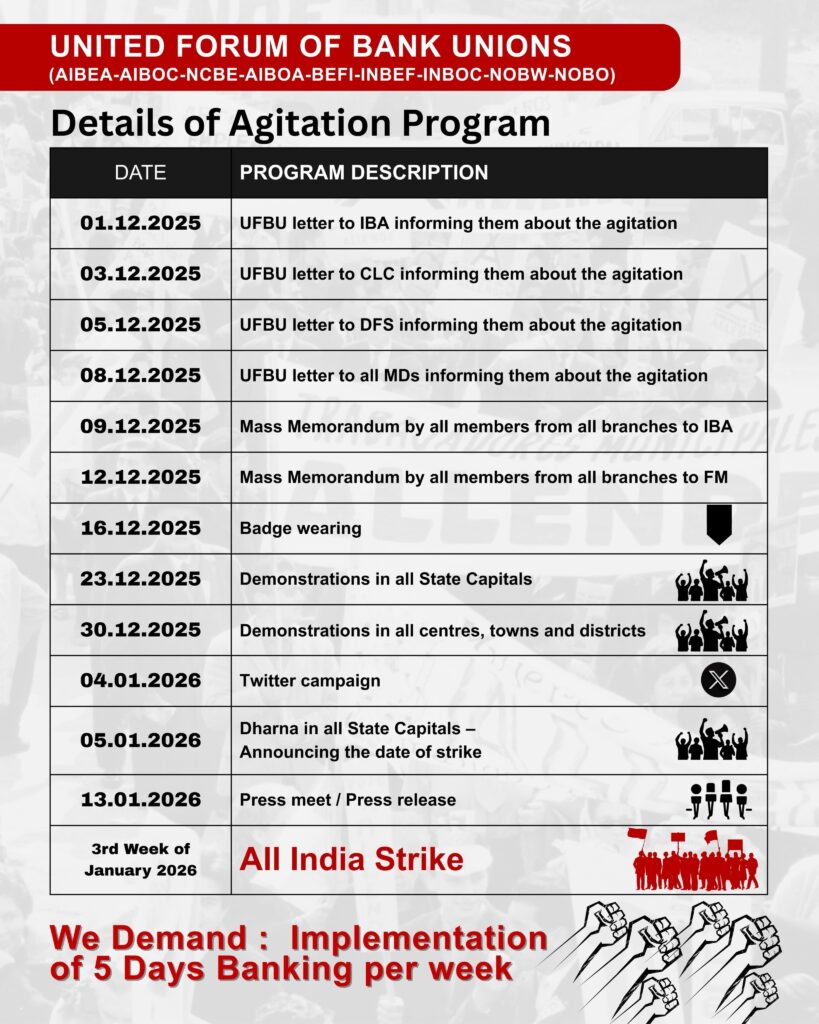

UFBU Announces Nationwide Agitation Programme Demanding 5-Day Banking Week

The United Forum of Bank Unions (UFBU), representing major bank unions including AIBEA, AIBOC, NCBE, AIBOA, BEFI, INBEF, INBOC, NOBW and NOBO, has unveiled a detailed nationwide agitation programme demanding the implementation of a 5-day banking week. The programme, which begins in December 2025, includes a series of coordinated actions culminating in an All-India Bank Strike in the third week of January 2026.

Timeline of Agitation Activities

1. Submission of Letters to Authorities

UFBU will initiate the campaign by formally informing key regulatory and administrative bodies:

- 1st December 2025: Letter to IBA (Indian Banks’ Association)

- 3rd December 2025: Letter to CLC (Chief Labour Commissioner)

- 5th December 2025: Letter to DFS (Department of Financial Services)

- 8th December 2025: Letter to all Managing Directors of banks

These communications highlight the unions’ concerns and officially place their demands before the authorities.

2. Mass Memorandums by Bank Employees

To demonstrate collective support from employees across the country:

- 9th December 2025: All members from every branch will submit a Mass Memorandum to IBA

- 12th December 2025: Members will submit a Mass Memorandum to the Finance Minister (FM)

3. Visible Protest Actions

UFBU has scheduled multiple on-ground and online protest activities:

- 16th December 2025: Badge-wearing by all employees

- 23rd December 2025: Demonstrations in all State Capitals

- 30th December 2025: Demonstrations in all centres, towns and district headquarters

These actions aim to show unity among employees while attracting public and administrative attention.

4. Digital and Public Outreach

- 4th January 2026: A dedicated Twitter campaign will be launched to amplify awareness among the public and stakeholders.

- 13th January 2026: Press Meet / Press Release to communicate the latest developments and reinforce the demand.

5. Dharna and Strike Call

- 5th January 2026: Dharna in all State Capitals, during which the official date of the strike will be announced.

- Third Week of January 2026: All-India Strike

This strike represents the culmination of weeks of organized protests, aiming to press the government and regulatory bodies to accept the long-pending demand.

Core Demand: 5-Day Banking Week

UFBU has reiterated its primary demand—Implementation of a 5-day banking week, aligning Indian banking practices with global standards. According to the unions, reduced working days will:

- Improve employee well-being

- Enhance productivity

- Help modernize banking operations

- Ensure better work-life balance

The unions emphasize that with digitization, customer services can continue uninterrupted even with a 5-day week.